2021 Report

ACP Physicians’ Financial Preparedness

Articles

8 Characteristics of Financially Prepared Physicians

Physicians who are financially prepared for retirement share eight distinct characteristics. And they all reveal key insights that younger physicians should pay attention to—especially when planning for their own retirement.

★★★

The American College of Physicians (ACP) recently surveyed internal medicine doctors to better understand their financial preparedness for retirement. The study maps personal financial attitudes and beliefs to financial behaviors. It provides physicians an opportunity to self-assess where they are on their journey to a secure retirement.

The study surfaced eight characteristics that differentiate doctors in each group by studying the attitudinal and behavioral differences between those who feel ahead or on track and those who feel behind in saving for retirement.

These eight characteristics include:

1. Retirement savings over $1 million.

Most physicians who feel ahead of schedule for retirement have more than $1 million saved for retirement, regardless of their age or career stage. In fact, nearly half of doctors who are most prepared financially for retirement have more than $3 million saved.

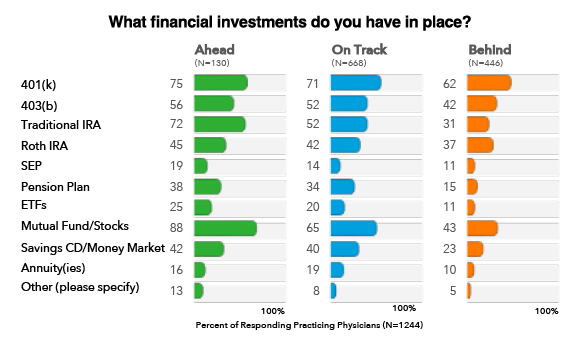

2. A diversified financial portfolio.

Those ahead of schedule invest in their qualified retirement plan at work and are more than two times as likely to have a traditional IRA, mutual funds/stocks, and CD/money market savings in their portfolio.

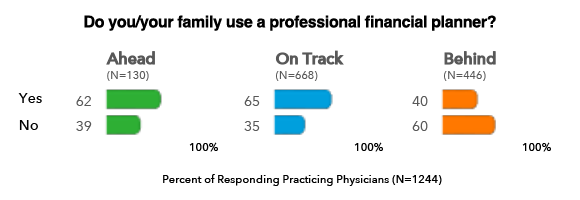

3. Use of a professional advisor.

Physicians who are ahead or on track for retirement are significantly more likely to use a professional financial advisor than those who are behind schedule. Most of those physicians say their advisor is a certified financial planner.

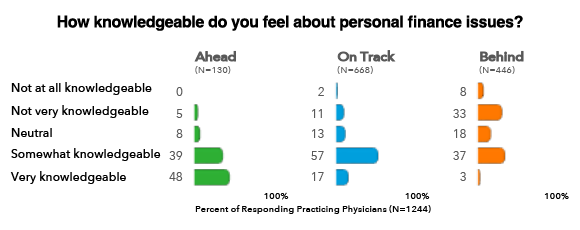

4. High personal financial intelligence.

Personal financial knowledge is a hallmark characteristic of physicians who also say they’re ahead of schedule for retirement. In contrast, 60% of those behind in saving for retirement do not consider themselves knowledgeable.

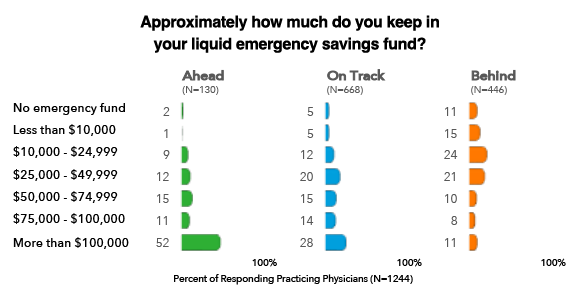

5. Adequate emergency reserve.

Half of all doctors who say they’re ahead of schedule for retirement keep more than $100,000 in a separate, liquid emergency fund. Those behind schedule are more likely to have less than $50,000, with 26% having less than $10,000 in emergency savings.

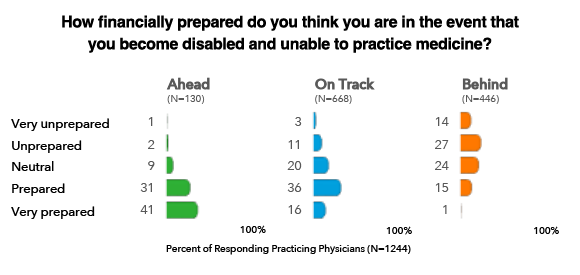

6. Sufficient life and disability insurance.

Most physicians who are financially prepared for retirement are also more financially prepared in the event of their premature death or disability. Conversely, those behind schedule are more likely to feel unprepared or very unprepared.

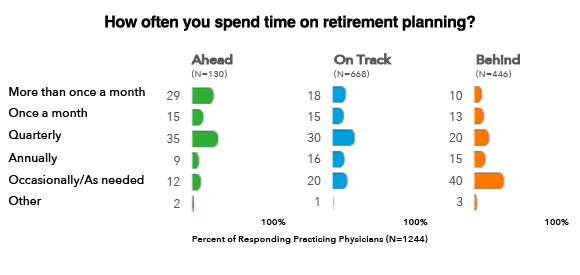

7. Adequate time spent on retirement planning.

Those who are behind for retirement say they spend time on retirement planning occasionally or on an as-needed basis. Physicians who are ahead of schedule review their retirement plans at least quarterly, and often more than once a month.

8. An estate plan that’s in order.

Across the board, financially prepared physicians are significantly more likely to have an updated will, medical directives, powers of attorney, and a trust. About 60% of those who feel behind do not have any estate plan elements in place for their family.

More from the experts

ACP asked two principals, Amy Braun-Bostich, CFP, and Cassandra Kirby, CFP, from the independent advisory firm Braun-Bostich & Associates, to review these findings and provide their financial advice for ACP member physicians in different financial situations. Read more about what they had to say.

Source: ACP Internal Medicine Physicians’ Financial Preparedness Survey conducted March to May 2021.

8 Characteristics of Financially Prepared Physicians

Retired Internists Share the Keys to a Satisfying Retirement

Ready to Wind Down or Retire? Experienced Physicians Share Their Advice

Residents Delayed in Retirement Journey Cite Heavy Debt, Lack of Finance Knowledge

15% Premium Credit on Disability Insurance for Internists Extended to 2022

COVID-19 Impacts on Internal Medicine Physicians

Positioned For a Secure Retirement. 95% of Retired Internists Confident in Nest Egg

Women Physicians Financial Preparedness: 2021 Report