2021 Report

Women Physicians Financial

Preparedness

Behind in Saving for Retirement Professional Advice to Help Change Course

Regardless of career stage in internal medicine, a comfortable retirement is a top personal financial goal for more than 90% of U.S. internal medicine physicians, residents, and fellows who responded to the study.

Research from the 2021 ACP Physicians’ Financial Preparedness Report shows that among the 10% of internists who feel ahead of schedule in saving for retirement take an active role in charting their course toward financial health. They are also generally in a stronger position to weather the unexpected and achieve the retirement they have been working toward.

But what if you feel behind in your savings goals?

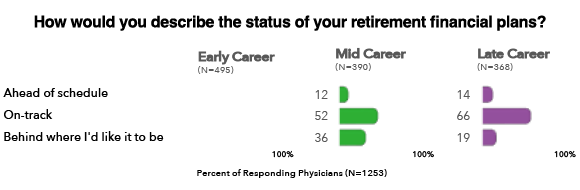

That is the situation for nearly half of early-career physicians and about one-third of physicians in their mid-career. About 80% of internists in practice for longer than 30 years say their retirement savings plan is on track or ahead.

To help physicians consider ways to turn their situation around, we asked two principals from the independent advisory firm of Braun-Bostich & Associates, Amy Braun-Bostich, CFP, and Cassandra Kirby, CFP, to review the findings and provide their professional advice for ACP member physicians who need to change course.

“For someone who is not on track, understanding the reasons why they are not on track is important,” says Amy Braun-Bostich. “Have they been overspending, did they mismanage debt, did they incur a string of bad life events that derailed them? Can they work longer, put aside more money, cut out discretionary expenses?”

To get back on track or stay on course, Braun-Bostich says the key is to analyze spending, keep debt low, and look for tax efficiencies. If you are repaying student loans, be sure to establish a logical debt paydown approach. Consider automating your budgeting to give you more control and insight into spending. Cash flow is your most important tool.

This may also be the time to consider seeking the advice of a professional financial advisor if you don’t already have one.

The 2021 ACP Physicians’ Financial Preparedness Report and related articles are the result of data and insights captured from more than 1,250 practicing internal medicine physicians including 469 women ACP members. Each shared their attitudes and behavior around personal finances, debt, retirement savings, and estate planning. Find more information on physician benchmarks, retirement planning, and other financial insights at acpmemberinsurance.com.