Women Physicians Financial Preparedness: 2021 Report

How are women in internal medicine faring on their journey to a satisfying and secure retirement? How do you compare? In this segment report, women ACP members can consider and compare their own personal financial situation with colleagues of the same gender, age and career stage to get relevant benchmarks, insights and advice on being financially prepared for retirement.

More than 450 women in internal medicine (N=469) were among 1,250 physician respondents to an in-depth financial preparedness survey from the American College of Physicians (ACP) and the ACP Member Insurance program. They also generously shared hundreds of pieces of advice for their peers.

Key findings:

● Achieving a comfortable retirement is the top personal financial goal among women internists, yet 67% express some level of concern about achieving their goal.

● More than 70% of women physicians are their family’s primary caregiver and breadwinner.

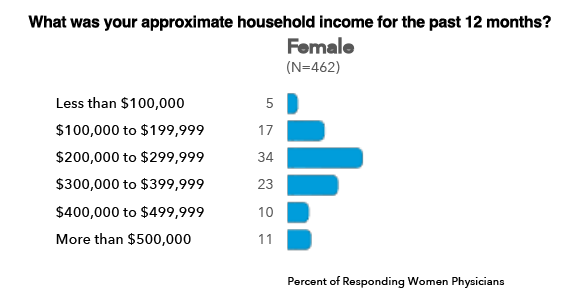

● Women internists have household incomes between $200,000 – $350,000.

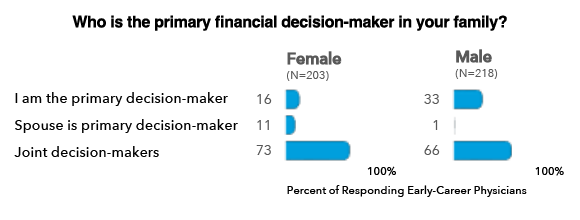

● Seventy-three percent of female physicians said they are joint decision-makers with their spouse or partner when it comes to personal financial decisions.

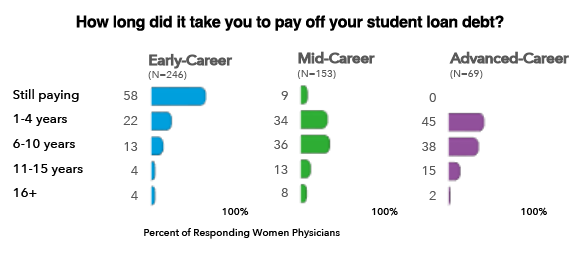

● Nearly 60% of women internists in their early career are still paying student loans.

● Female internists were more likely to say they lack personal finance knowledge and confidence in their decision-making than their male counterparts.

● Less than 40% of early-career physicians have a professional financial planner guiding them.

● Only 26% of early-career women physicians say they feel financially prepared should a disabling incident impact their ability to practice internal medicine.

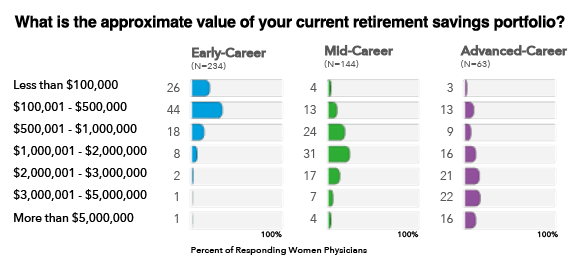

● Two-thirds of women internists in practice for 30+ years have more than $2 million saved for retirement including 20% with more than $5 million in savings.

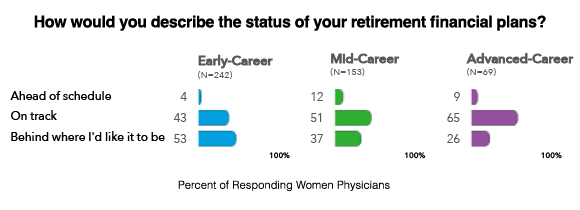

● About half of the women physician respondents said they consider their retirement portfolio to be on track or ahead of schedule, and half feel they are behind where they’d like to be.

Achieving a comfortable retirement is the top personal financial goal among women internists, yet 67% express some level of concern about achieving their goal

Regardless of age or career stage, female internists said their most important personal financial goal is ensuring a secure retirement for themselves and their spouse or partner. Early- and mid-career doctors also expressed concern for competing financial priorities including paying off student loans and saving for their children’s education.

Two thirds of women internists in practice for 30+ years have more than $2 million saved for retirement including 20% with more than $5 million in savings. Most early-career physicians reported less than $500,000 saved, and in their mid-career $1 million or more.

More than half of women physicians in their early career (0-16 years in practice) said they started saving for retirement during residency or even earlier, while 62% of advanced-career physicians (> 30 years in practice) started saving post-training as qualified retirement plans were coming of age.

These women investors contribute to their qualified retirement plan through work, and investments in traditional IRAs (42%), Roth IRAs (45%), Mutual Funds/Stocks (55%) and CDs/Money Market (29%). An additional 12% use ETF’s (Exchange-Traded Funds) and 25% have a pension.

Retirement readiness: A self-assessment

When asked to evaluate the status of their overall retirement savings plan, the results were divided: half of the women physician respondents said they consider it on track or ahead of schedule, and half feel they are behind where they’d like to be at this point in their career and time in their life.

While age and experience does tend to contribute to increased feelings of confidence of being on the right track, it’s important to note that there are financially prepared female physicians at every age and career stage.

The study identified 8 characteristics shared by internists who are ahead of schedule:

- Retirement savings over $1 million.

- Diversified financial portfolio.

- Uses professional advisor

- High financial intelligence.

- Adequate emergency reserve.

- Sufficient life and disability insurance.

- . Spends adequate time on retirement planning.

- Estate plan is in order.

Find additional insights, detailed findings by career stage, and answers to financial questions in the 2021 ACP Physicians’ Financial Preparedness Report.

Professional financial advice provided by Amy Braun-Bostich, CFP®, and Cassandra Kirby, CFP® from the independent advisory firm of Braun-Bostich & Associates.

Family caregiver and breadwinner

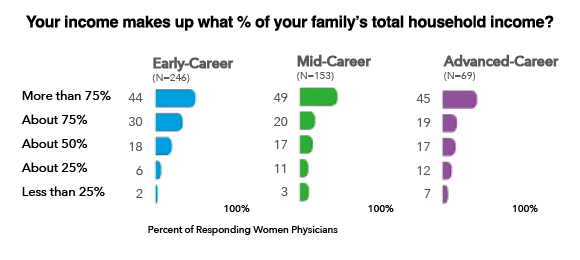

Regardless of career stage, the study showed that 70% of female internists contribute 75% or more to their family’s household income, providing care and financial support to their spouse or partner, children, and as often other family members, including elderly parents.

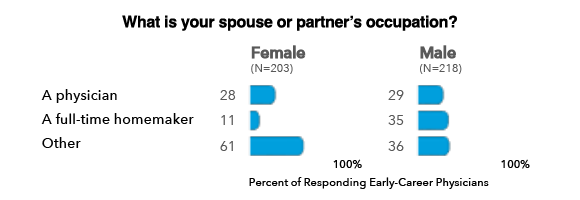

Most women respondents (81%) are married or unmarried with a partner, including nearly 30% who are married to another physician.

Despite the fact that two-thirds of both women or men physicians in practice less than 17 years have children under age 18, just 11% of female physicians in their early career said their spouse or partner is a full-time parent/homemaker, versus 35% of male physicians in the same career stage.

Household income for women in internal medicine

Women physician respondents to the survey said their household earned approximately $200,000 – $350,000 in income before taxes the previous year.

Approximately 45% of internal medicine physicians have a household income over $300,000. There were no significant differences found by career stage or gender.

Shared financial decisions

Overall, 73% of female physicians said they are joint decision-makers with their spouse or partner when it comes to personal financial decisions, and planning compared to 66% of male physicians. Even early in their career, 33% of male internists say they are the primary decision-maker, versus 16% of female internists.

Student loans and consumer debt

Nearly 60% of women internists in their early-career are still paying off their medical school debt. Women in their mid- and advanced- career generally repaid their loans in less than 10 years. The study found that 33% of women physicians graduated with no debt.

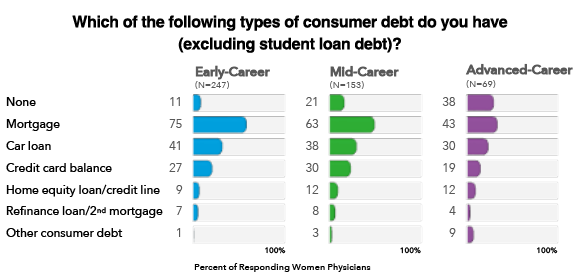

Approximately one-quarter of female physicians have credit card debt, especially during the early- to mid-career years. Three-quarters of women in their early-career have a mortgage, even while repaying education loans.

As they move past 30 years in practice, many have retired their mortgage and 38% of responding advanced-career internists do not have any debt at all.

Financial literacy

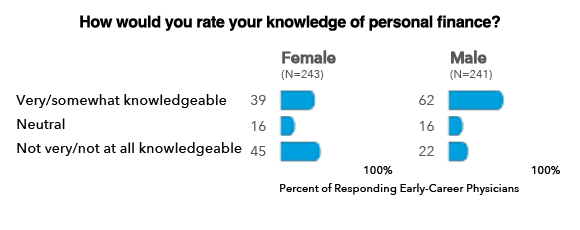

National studies have shown that female investors tend to report lower understanding in financial literacy and confidence in their decision-making than male peers in the same age group, even when their financial picture looks roughly the same.

Among early-career physician respondents (50/50 M/F), female internists were significantly more likely to say they feel they are not very or not at all knowledgeable about personal finance, and twice as likely to say that they lack confidence that the financial decisions they are making for their family are the right ones.

The study found that only 7% of the total responding physicians took a college-level accounting or finance class at any point in their education. Financial planning is simply not taught in medical school or during residency so most have learned the fundamentals of investing and planning on their own, by asking others, or by engaging a professional financial advisor. Learning about finance takes time, which physicians have little to spare.

In survey comments, experienced female internists encouraged younger colleagues to make the time to focus on your finances noting that “it’s just as important as the medical-clinical aspects of our careers.” Another doctor stressed the need to “let go of financial mistakes and move on; we have all made them.”

Professional financial advisor role

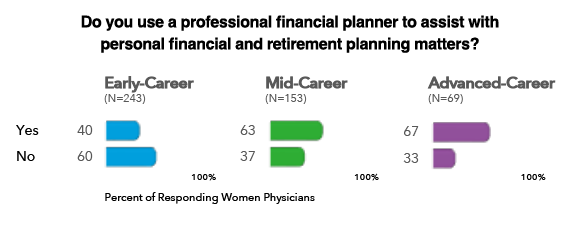

About two-thirds of mid- and advanced-career internists have engaged a professional financial planner, and more than 80% say their advisor is a Certified Financial Planner (CFP). Less than 40% of early-career physicians have a professional guiding them; either because they prefer to do it themselves or simply lack the time to find someone they trust.

In comments, respondents emphasized the importance of working with a professional advisor.“ Just like we prefer our patients to see out our medical services rather than WebMD, the same goes for financial services.” Others stressed the importance of selecting a fiduciary and not to be “an arm-chair financial planner.”

Women internists who prefer to handle their own finances point out the importance of doing your own financial research, investing time in the beginning, and with minimal checkups once everything is arranged, you can handle your finances without an advisor. ”No one will care about your money more than you,” one doctor added.

However, the study found that internists who work with a professional planner are more likely to feel on track or ahead of schedule for retirement, have more in retirement savings than peers in the same age and career stage, and express greater confidence in decisions they are making.

Learn 5 steps to selecting a fiduciary advisor, including when it’s time to walk away.

Risk mitigation and family protection

Female and male respondents stressed the importance of protecting yourself by preparing for life’s unexpected events and helping to thwart the financial risk that can come along with them.

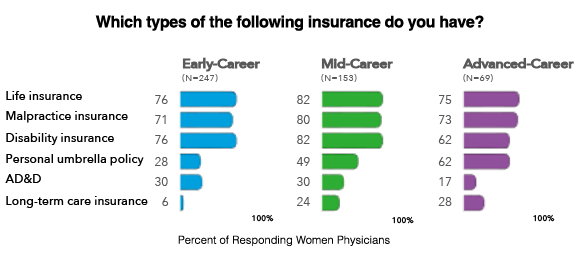

Nearly three-quarters of women internists have life and disability insurance, including those with two or more policies which they purchased through work, a broker, an agent, or the ACP Member Insurance Program.

Despite coverage from their employer, only 26% of early-career women physicians say they feel financially prepared for a disabling incident that could impact the ability to practice internal medicine. Many women suggested investing in a good disability insurance that protects your specialty—and buying it early in your career.

Beyond insurance, others advised prudence when it comes to decision-making, being comfortable enough to ask lots of questions, and ensuring your concerns are addressed. Another reminded colleagues to “READ the FINE PRINT,” and make sure you understand what you’re investing in before you invest.

Wills and directives

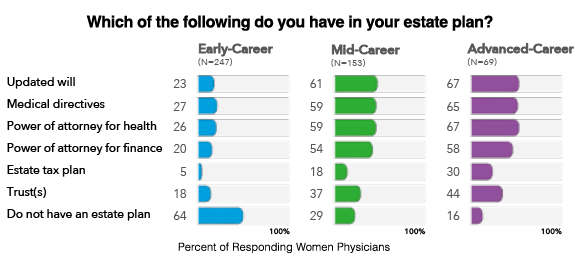

An unexpected find from the study reveals that only about 25% women internists in their early career have an updated will, medical directives, or power of attorney in place despite 66% having children.

By the time physicians have been in practice for more than 30 years, nearly 75% have updated estate plan documents and half have a trust in place.

When is the right time to think about your estate plan? “It’s generally recommended to draft your estate plan early in your career when your assets begin to accumulate,” says Certified Financial Planner, Amy Braun-Bostich of Braun-Bostich and Associates, who reviewed the findings and provided financial advice for the report. “From there, it’s best to revisit and revise your wills and directives every three to five years, or after major life events such as marriage, divorce or having children.”

However, physicians are not necessarily different from other people in this regard. “Many clients, regardless of occupation, seem to procrastinate when it comes to planning and executing their estate documents”, says Braun-Bostich.

Peer-to-peer advice on money and personal finance

Women ACP members shared candid advice on money matters, hard-learned lessons, and thoughts on achieving financial freedom as an internal medicine physician:

“Be aware of your attitude toward risk taking and plan accordingly.”

“Do not sign up for a financial advisor that is not a fiduciary and is just getting you to purchase cash value life insurance so they can benefit.”

“Start saving early, live simply, get a good financial advisor early, know your limitations, pay off your debts as early as you can, carry your lunch!”

“Pay yourself first. Maximize contributions to the limit for all retirement accounts and then live on the rest without borrowing.”

“Hire the darn planner already, we have enough to worry about.”

“Identify the things that are important to you outside of medicine and budget for them.”

“Save prudently but don’t forget to enjoy yourself along the way.”

“Keep both long- and short-term goals. An imbalance in either will create unnecessary anxiety.”

“Never spend more than you make. Give to charity. Live in gratitude.”

“Get informed about personal finance early in your career.”

“Only marry someone on the same page as you are financially.”

“Get disability and life early before you have medical issues so it’s cheaper.”

“Your wealth is determined by how much you spend; not how much you earn.”

“Purchase experiences with your family rather than toys.”